Best 10 Bitcoin Exchanges in Australia

Bitcoin became a household name in 2017 and this cryptocurrency exploded into the mainstream very fast since its inception in 2009. Cryptocurrency value tracker Coindesk places the value of one bitcoin on January 1, 2017, at the price of $997.69. On December 16 of the same year, it reached $19,343, a near-2,000 percent increase in value. Had you converted $60,000 into bitcoins at the start of the year, they would now be worth more than $1 million.

Soon after hitting the Chicago Board Operations Exchange in December, futures contracts surged by 26 percent on the first day. As the cryptocurrency pushed past the $15,000 mark, the Winklevoss twins made headlines as the first crypto-billionaires. The Coinbase and Blockchain.io exchanges saw unprecedented levels of traffic as people piled in for a piece of the action. The future of Bitcoins is bright as per the report published by statista the bitcoin index value for the end of January 2018 amounted to 10,166.51 U.S. dollars.

Bitcoin Is Legal In Australia

In Australia according to Finder survey of 1,004 Australians has revealed that 1 in 4 people (26%) invest in cryptocurrency. That’s equivalent to 5 million digital currency investors. Bitcoin is the most popular form of cryptocurrency, with 13% of Australians investing in it.

- As of March 2021, the average number of confirmed Bitcoin transactions per day over a 30-day period was around 330,000.

- Approximately 3 million Redditors subscribe to the r/Bitcoin community.

- In one day, on 29 January 2021, there were over 196K tweets about Bitcoin. Interest on Twitter has been dwindling, with only 76K Bitcoin tweets recorded on 7 February 2021.

In terms of market capitalisation, Bitcoin is the biggest by far. The second biggest crypto is Etherium which holds just 12% of the total market cap of the top 250 coins compared to Bitcoins 60%.

According to Comply Advantage cryptocurrencies and exchanges are legal in Australia, and the country has been progressive in its implementation of cryptocurrency regulations. In 2017, Australia’s government declared that cryptocurrencies were legal and specifically stated that Bitcoin (and cryptocurrencies that shared its characteristics) should be treated as property, and subject to Capital Gains Tax (CGT). Cryptocurrencies had previously been subject to a controversial double taxation under Australia’s goods and services tax (GST) – the change in tax treatment is indicative of the Australian government’s progressive approach to the crypto issue.

Online Casinos & Bitcoins

The online casinos were not far behind and now most of the online casinos accept Bitcoins as one of the deposit options making things easier in the gambling arena for players to enjoy real game slots and other casino games with BTC. To buy and sell Bitcoin exchanges play a very important role. Many new BTC exchanges rolled out to making things easier to Bitcoin users all over the world. With these bitcoin exchanges, you can have bitcoins, store them and use them when you want.

For those who are new to Bitcoin exchanges remember that a Bitcoin exchange is a digital marketplace for users to buy and sell Bitcoins using different currencies. The Bitcoin can be exchanged for either fiat money (legal tender) or other alternative cryptocurrencies such as Ethereum. The exchange serves as the middleman for traders of the cryptocurrency.

Being able to purchase Bitcoin is the initial step to trading in it. Just like trading a stock, Bitcoin exchanges charge transaction fees, which range from 0 to 1%. In order to trade Bitcoin on an exchange, the user needs to have an account, and go through a series of steps to be verified. Remember that Bitcoin and alternative cryptocurrencies are a completely digital currency, and there are no physical Bitcoins.

Following are best 10 Bitcoin Exchanges in Australia available for you to open your BTC accounts with.

1. Swyftx

- Low Fees

- Over 240 + other crypto-assets

- Supports both mobile and desktop

- Biometric logins and 2FA security

Australian crypto exchange Swyftx is best exchange to buy, sell and trade cryptocurrencies in Australia. Swyftx Crypto exchange is an Australian owned and operated exchange that allows users to buy Bitcoin, Ethereum and 240+ other crypto-assets. Backed by global liquidity providers, this Australian cryptocurrency exchange is able to offer some of the lowest trading fees and smallest spreads on the market. Supporting both a mobile and desktop trading application, Swyftx allows you to buy, sell and trade cryptocurrencies anywhere, at any time from the convenience of your mobile phone while being protected by two-factor authentication and biometric logins.

2. Coin Jar

- Budgetable Fees

- Trade multiple different digital currencies against Australian dollars and Bitcoin.

- Supports both mobile and desktop

- Offers CoinJar Swipe Australia’s first digital currency EFTPOS card

Established in 2013, CoinJar is one of the longest-running digital currency exchanges in the world. This exchange allows users to buy, sell, store and spend digital assets. As an award-winning, venture capital-backed exchange, they are known for their simple and easy-to-use products. Innovations such as the popular digital currency debit card, CoinJar Card, and their mobile applications CoinJar iOS or Android app have put digital currency in the hands of hundreds of thousands of people.

Note that BPAY transfers from a credit account are not officially supported, and will encounter payment processing fees. BPAY deposits under $10 will also incur a $1.5 processing fee. Transfers involving currency exchange are subject to CoinJar’s currency conversion rates, which are always quoted during the transaction confirmation.

3. Binance

- Low Fees

- Trade more than 740 cryptocurrency and fiat pairs

- Complex security measurements and SAFU fund protect your data and assets against all risks.

- Supports both mobile and desktop

Binance is another exchange among the Best 10 Bitcoin Exchanges in Australia where you can trade more than 740 cryptocurrency and fiat pairs, including Bitcoin, Ethereum, and BNB with Binance Spot. Experience seamless trading with the largest crypto exchange by trade volume. Their matching system is capable of processing up to 1.4 million orders per second. Deposit AUD using PayID and enjoy zero-fees. Start buying Bitcoin or any other popular cryptocurrency with AUD here. Their low fees and attractive VIP program beat the competition as you can enjoy some of the lowest transaction fees in AUD. All NPP-enabled Australian banks or credit unions support NPP payments (PayID/Osko) into your unique Binance Australia PayID.

4. Coin Spot

- Good for beginners and advanced traders

- Over 270 digital currencies

- Budgetable fees

- Supports both mobile and desktop

At Coin Spot best bitcoin exchange in Australia you can easily buy Bitcoin, Ethereum, XRP and over 270 other digital currencies directly from your CoinSpot account. You can even swap directly between any currency listed on the platform. For high value trading, institutional investment, and Self Managed Super Funds they have a dedicated OTC (Over The Counter) Trading Desk & SMSF team to assist with all aspects of account management. At this exchange if you refer a friend you earn $10 BTC free.

5. eToro

- Budgetable fees

- Supports both mobile and desktop

- VIP Service

- Customer support

Launched in 2007 eToro is another best bitcoin exchange in Australia. This online trading platform makes trading easy to understand, and even fun, using graphic representations for various financial instruments.eToro offers, enabling clients to trade and invest in Ethereum, XRP (by Ripple Labs), Litecoin, and other popular cryptocurrencies. Start trading with a minimum first-time deposit of as low as $200! After your first deposit, there is a minimum deposit amount of only $50.

eToro Club members receive an exceptional level of service as well as a host of other services. Enjoy additional privileges with each tier upgrade from Silver to Diamond level.

6. Digital Surge

- Funds stored offline in cold storage

- Highly sophisticated multi-layered security

- Low Fees

- Supports both mobile and desktop

Digital Surge offers a safe and uniquely user-friendly way for everyday Australians and businesses to access the world of cryptocurrency. Their platform is built on the belief that technology has the power to simplify cryptocurrency and enrich your lives. Digital Surge has been recognized by a number of well know media outlets as an exciting new venture with the potential to transform cryptocurrency exchange in Australia.

When placing a trade on the exchange, the fees are calculated based on your rolling 30 days trade volume. Your trading volume is calculated every 1 hour. This exchange dont charge any fees for any AUD withdrawals. When sending coins to an external wallet, you will be charged a standard network transaction fee. The fees for each coin will vary based on how busy the network is. The current fee is displayed when withdrawing a coin. Cryptocurrency and PayID deposits are free. POLi deposit fees start at $2 and are capped at $3.30.

7. Coin Tree

- Low Fees

- Supports both mobile and desktop

- Trade 130+ cryptocurrencies

- Excellent help support

Cointree is another best bitcoin exchange in Australia. They provide cryptocurrency users with a platform that is easy to use, and more-so, simply works. Developed in Melbourne in 2013 they are designed to educate and excite, providing users with all the tools to buy, sell and explore the exciting world of cryptocurrency. Convenient AUD deposit options. Instant deposits with PayID and POLi. Cash available too. Complete your first purchase within 5 minutes. Every crypocurrency purchase can be stored in your Cointree account for free.

8. Zipmex

- Low fees

- Customer support

- Supports both mobile and desktop

Zipmex is best bitcoin exchange for Australians with instant trades, withdrawals and deposits to your AUD bank account. Before you can start buying and selling, you’ll need to deposit funds into your Zipmex account. Once your account is funded, you can use the order forms under the “Buy & Sell” tab to place orders. The Fiat Currency Withdrawal Fees (Bank Transfer) is 5 AUD, and Minimum Withdrawal Amount is10 AUD. The fees are charged by their payments partners upon processing your withdrawal, but intermediary or correspondent banks may also charge fees or convert the transaction to a different currency en route. Get $10 reward at this exchange if you refer a friend.

9. Coin Mama

- Bugetable fee

- All major cryptocurrencies available

- Customer support

- Supports both mobile and desktop

Coinmama makes it easy to buy Bitcoin in Australia with just a few clicks. Buy Bitcoin with credit card, debit card, or bank transfer and receive your coins instantly. With Coinmama, you can also buy Bitcoin directly from your bank account with SWIFT in Australia. When you buy with a bank transfer, you enjoy higher daily spending limits than when you purchase with a credit or debit card and receive your coins in approximately one business day. Buying above $1,000 won’t include any additional fees. Smaller SWIFT purchases below $1000 USD have a “below the minimum“ fee of 20 GBP.

With Coinmama, you can convert AUD to BTC from the comfort of your home or via your smartphone when you are in transit with the same effectiveness.

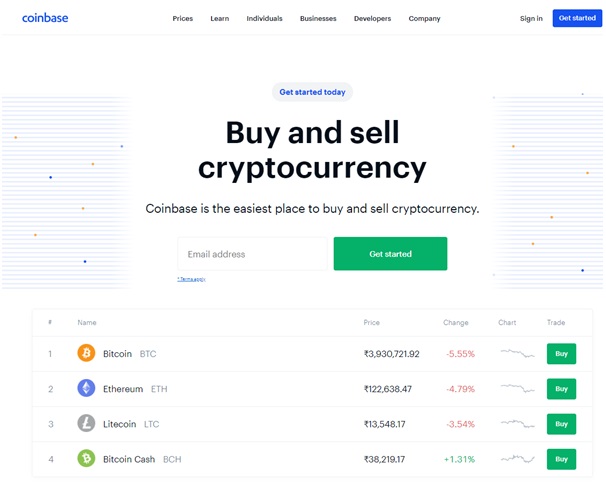

10. Coinbase

- Oldest exchange

- Budgetable fees

- All major cryptocurrencies available

- Customer support

- Supports both mobile and desktop

Coinbase is popular and best bitcoin exchange in Australia that was launched in 2012 with the radical idea that anyone, anywhere, should be able to easily and securely send and receive Bitcoin. Today, they offer a trusted and easy-to-use platform for accessing the broader cryptoeconomy. Approximately 43 million verified users, 7,000 institutions, and 115,000 ecosystem partners in over 100 countries trust Coinbase to easily and securely invest, spend, save, earn, and use crypto. Australians can trade in here and buy bitcoins. Australian customers can make a purchase with a debit card. With this payment method, you will not have to pre-fund your account to place an order. Your purchases will complete instantly.

Besides these best 10 Bitcoin Exchanges in Australia, you can also have other popular exchanges like LocalBitcoins, itBit, and many more that you can read here.